Environmental Upgrade Agreements

An Environmental Upgrade Agreement is a relatively new form of financing that makes it easier and cheaper for property owners to retrofit and improve the energy efficiency of old commercial and industrial buildings.

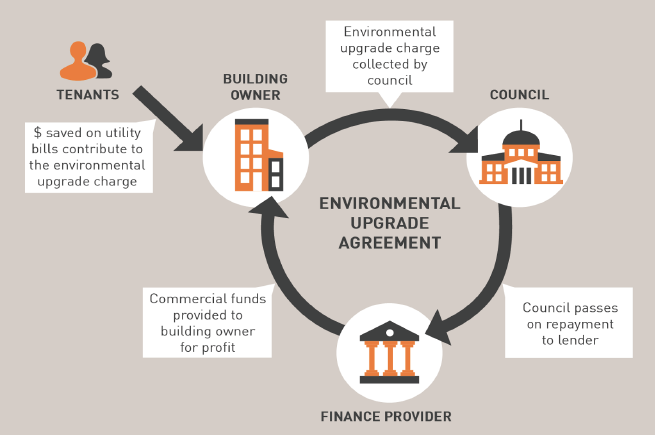

An Environmental Upgrade Agreement (EUA) involves three parties: the building owner, the finance provider and the council. Together they sign an EUA under which:

• The building owner borrows funds from the finance provider to fund an energy efficiency upgrade and/or environmental improvements. The EUA sets out the conditions of the loan (term, principal, interest, etc).

• The building owner makes the repayments of the loan to council (although the council is not obliged to make payments until it has received an equivalent amount from the building owner).

• The council provides an Environmental upgrade charge notice to the building owner. This amount is the same as the repayments due to the finance provider. The council collects the payments from the building owner in the same way that it collects rates. The council then passes on the funds to the finance provider.

• If the building owner fails to make payments, the council must enforce the payment using its powers of enforcement, generally in the same way that it can enforce payment of council rates.

• The building owner may charge this cost back to their office tenants, but only where the charge is smaller than or equal to savings the tenant will make in energy reduction costs.

• If the property is sold, the purchaser of the property can elect for the environmental upgrade charge to continue to run with the land. Alternatively they can elect for the vendor (the outgoing building owner) to prepay the council and have the environmental upgrade charge released. In that event, the council would fully repay the finance provider.

The benefits are numerous:

• 100% project finance can be obtained with no upfront capital required.

• A building owner can obtain a loan with lower fixed interest rates than standard commercial loans.

• It improves the cash flow of the building owner as funding can be accessed with the need for large amounts of upfront equity.

• The finance has longer loan terms for repayment.

• Savings from the energy efficiency upgrades can be used to help repay the loan.

This form of energy efficiency financing has already been introduced by the City of Sydney, Melbourne City Council and other local government areas. It’s anticipated that many other councils will introduce EUAs in their local area. So if you have a building that could benefit from an EUA, talk to your local council to see if they can enter into an EUA.[1]

Advantages and disadvantages of environmental upgrade agreements

| Option | Description | Advantages | Disadvantages |

|

ENVIRONMENTAL UPGRADE AGREEMENTS (EUA)

|

|

|

|

Further information on financing energy efficiency upgrades

The tables in this step are from the ‘Energy Efficiency and Renewables Finance Guide’ from the NSW OEH. It’s an excellent guide for medium to large companies who wish to finance energy efficiency upgrades and improvements.

The author would like to thank the NSW OEH for giving us permission to reproduce the tables from this guide. It can be downloaded from EnergyCut.info/oeh-finance

- 1. This information has been adapted from an article by Jeremy King from Corrs Chambers Westgarth that was dated 12 April 2013 – it is correct as at the time of printing: EnergyCut.info/westgarth-article

- 2. Table source: NSW OEH ‘Energy Efficiency and Renewables Finance Guide’